CBRE Office Index: Take-up in city centers and suburbs on the rise

CBRE presents the "Switzerland Office Take-Up Index" for the first time. According to the index, office take-up is rising in the major conurbations but falling outside them.

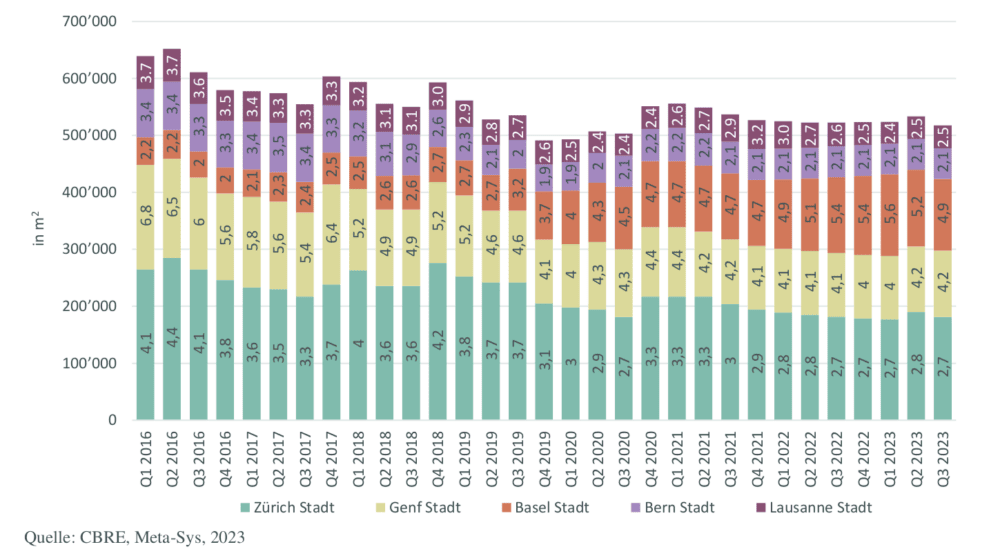

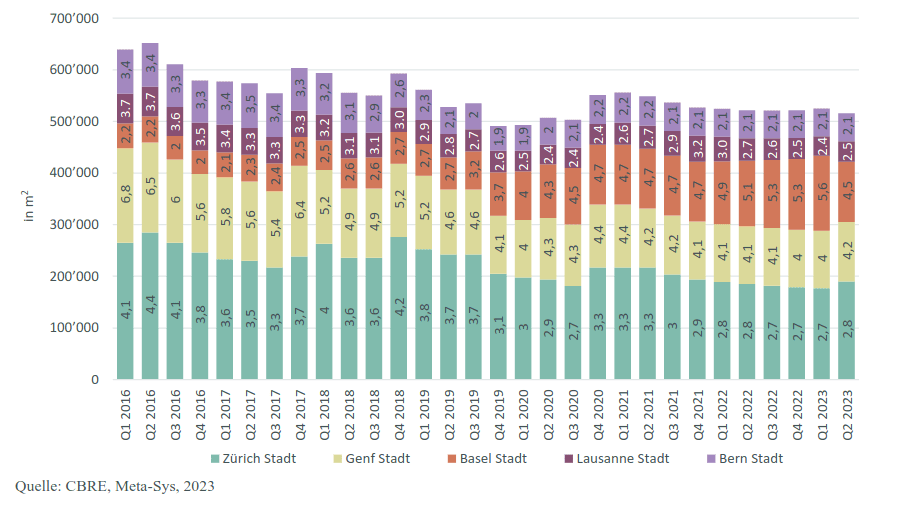

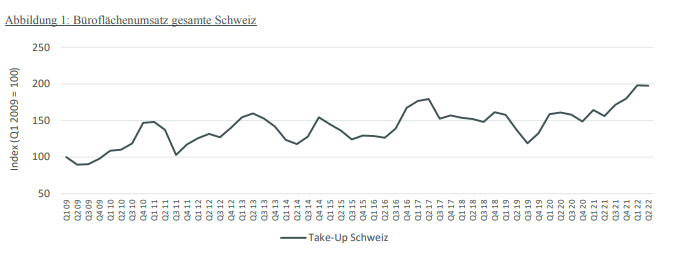

The Swiss office market is defying the global uncertainty. This is one of the findings of the "Switzerland Office Take-Up Index" published for the first time by consulting firm CBRE. The index is based on listings on real estate online marketplaces and tracks the quarterly volumes of space co-let on the Swiss office market. The index is presented for the whole of Switzerland as well as for three geographical submarkets.

All sub-indices have shown record office leasing activity since Q4 and especially since early 2022, according to CBRE. The overcoming of the Covid 19 crisis has led to companies resuming their often paused real estate projects. Leasing activity also increased again recently in the suburban areas of Switzerland's largest cities. In the cities themselves, CBRE has observed only a slight increase in take-up. The brokerage firm explains this with the fact that the average availability rate here is a low 3.1%. "Large space leases are thus now taking place only rarely or 'off-market' away from the measurable online channels," CBRE comments. In contrast, space take-up in the rest of Switzerland outside the metropolitan areas of the major cities is already declining slightly, he said. "The pronounced desire for centrality with the end of the COVID-19 pandemic has led to further declining office vacancies in the city centers, which is why space turnover is now also shifting to the well-developed suburban areas," says David Schoch, Research & Consulting CBRE Switzerland.

Index methodology only takes online listings into account

Methodology of the index: The quarterly calculation of the take-up is based on the advertisements of the online real estate marketplaces and is shown as a centered average of three quarters. If listings are taken offline and not relaunched within a certain period of time, they are included in the take-up. Direct lettings, i.e. lettings of space that has not been advertised on the online marketplaces, are not taken into account. For example, in the case of larger properties, the pre-letting of project developments or owner-occupied new buildings, often not all or any space is advertised. At the same time, however, space is repeatedly taken off the grid completely or temporarily for various reasons without a successful lease, which has a positive effect on the amount of take-up. Lease renewals are not included in the take-up. The index base is the first quarter of 2009, i.e. the beginning of the low interest phase and a cyclical low. (aw)