Suisse Romande Property Fund: Income up slightly in the first half of the year

The fund recorded an increase in total income of 1.7% to CHF 9.2 million. Net income fell slightly.

The Suisse Romande Property Fund (SRPF) closed the first half of 2025 with a net result of CHF 3.65 million (previous year: CHF 3.9 million). Total income including revaluation improved from CHF 1.7 million to CHF 7.9 million. The fair value of the portfolio rose by CHF 2.7% to CHF 406.4 million over the course of the half-year. According to the fund management company, this increase was due to investments made and the re-letting of vacant space. Total income rose by 1.7TP3T to CHF 9.2 million. The portfolio's vacancy rate fell from 7.0 to 5.2% within a year.

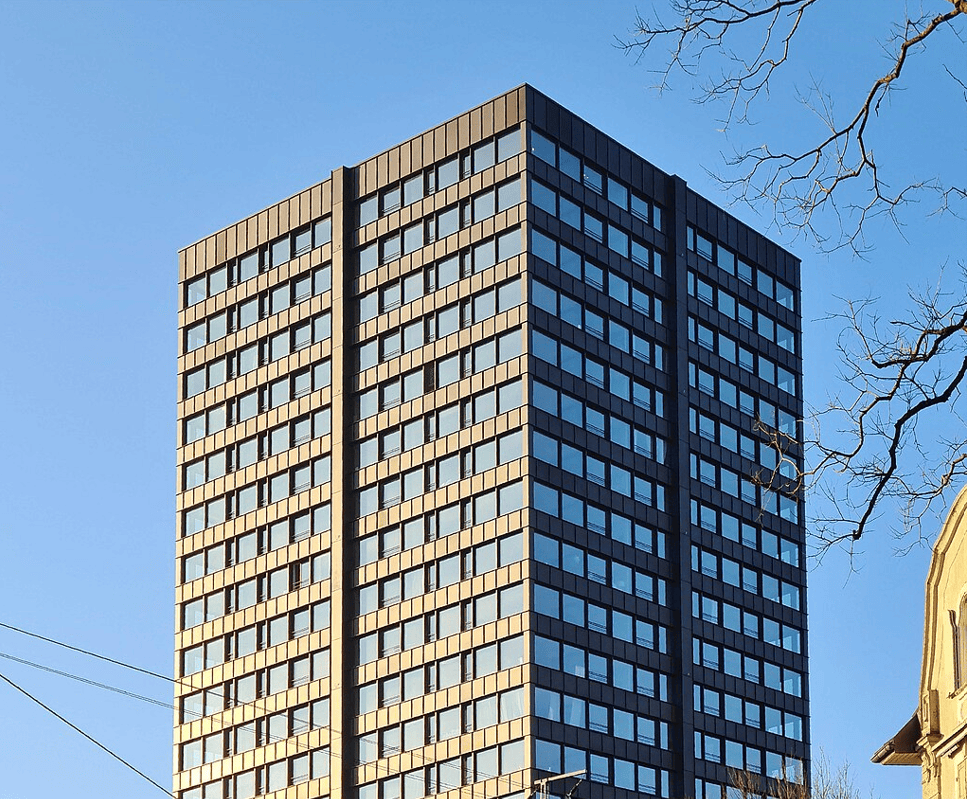

In June 2025, SRPF signed the forward sale of the commercial property Mouille-Galand 5 in Vernier (GE), according to a press release. The transaction took effect on August 15 and reportedly generated added value of over CHF 3.5 million. "The proceeds from this sale will be used for acquisitions of residential properties that are currently being negotiated," the fund writes.

Focus on residential real estate

The fund wants to focus more strongly on residential real estate again and is aiming for a share of 75 % in residential and mixed-use properties by the end of 2026. "The fund is thus entering a new phase that is characterized by growth and focuses on value creation and sustainability," it says.