Hiag: Profit up significantly after valuation

The real estate stock corporation is readjusting its strategy and intends to focus more strongly on the existing portfolio and "capital recycling" in the future.

Completed projects contributed to higher real estate income at Hiag in the first half of the year. A profit was also generated from the sale of properties no longer in line with strategy. However, revaluation gains, which were significantly influenced by progress in project development, were also a key factor.

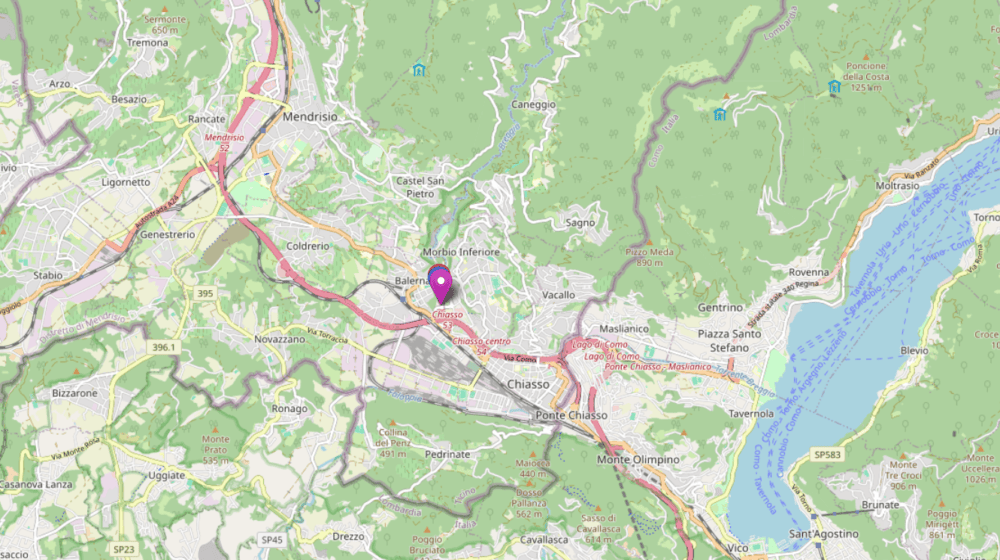

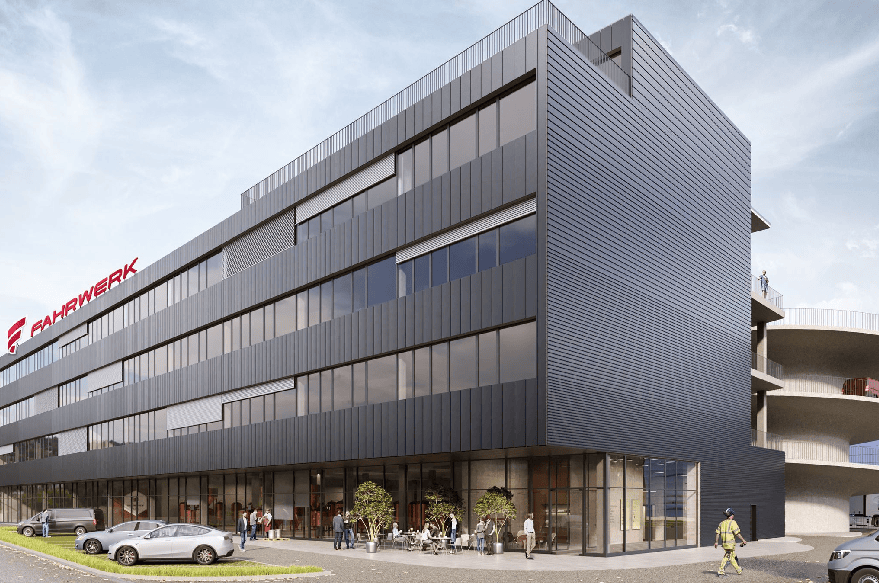

Real estate income increased by 5.8% to CHF 39.3 million. The completed "Fahrwerk" commercial building in Winterthur made a contribution. The vacancy rate for the entire real estate portfolio was 4.4%; excluding the initial vacancy rate for the "Fahrwerk", it was 2.5%. Progress in the real estate projects led to a net appreciation of the development portfolio in the amount of CHF 17.2 million or 2.2%. The existing portfolio saw a net appreciation of CHF 9.4 million or 0.8%, which is significantly more than in the same period of the previous year (H1 2024: CHF 1.0 million or 0.1%). In the first half of the year, Hiag sold residential and commercial properties that were no longer in line with its strategy at prices that were reportedly around CHF 25% above the book values on average, resulting in income from sales of CHF 3.5 million. The company reports that it took advantage of the brisker transaction market.

EBIT and net profit significantly increased

EBIT increased by CHF 201TP3k to CHF 54.9 million, reflecting the valuation effect as well as higher property income and higher income from sales. Net profit rose even more significantly, by 23.3% to CHF 44.6 million. Adjusted for the revaluation effects, however, net profit fell from CHF 25.5 million to CHF 20.5 million. Hiag attributes this to income from the sale of condominiums from the "Columbus" project, which had influenced the previous year's figure.

Greater focus on existing portfolio and sales

In the course of the half-year report, Hiag also hinted at an adjustment to its strategy: Although this would "continue to be based on the proven three pillars of site development, portfolio / asset management and transactions", the properties in the existing portfolio would "gain in importance as a stable source of income". At the same time, capital recycling is to be expanded and additional yield potential tapped with "intensified transaction activities." This shift is apparently to be at the expense of project development. However, this remains "a strong pillar of growth and earnings that complements the portfolio and transaction business with attractive additional returns."

Hiag speaks of a "sharpening of the corporate strategy", as part of which projects are also to be prioritized and the project portfolio streamlined. The planned open investment volume of projects under construction or about to start construction amounts to around CHF 202 million and the expected rental income from these projects to around CHF 17 million. The sale of condominium units is expected to generate proceeds of around CHF 154 million. (aw)