Office market: demand remains subdued

Office rents are still on the upswing, but Wüest Partner expects a sideways movement soon against the backdrop of stagnating demand and growing supply.

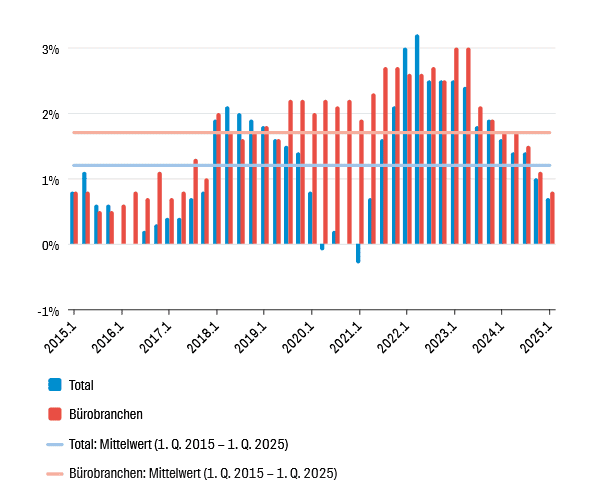

Declining employment growth is slowing demand for office space, according to an update from Wüest Partner. In the first quarter of 2025, the number of full-time equivalents rose by only 0.7%, remaining noticeably below the average of the last ten years, which was 1.2. The boost in the traditional office sectors also remains moderate: plus 0.8%, compared to a long-term average of 1.7%. "Accordingly, we expect to see less demand momentum on the Swiss office space market in the short term," diagnoses Wüest Partner.

New construction activity remains subdued

The construction of new office space remains at a rather low level. Although the investments approved in the past twelve months rose by 83% compared to the previous year, this increase is almost exclusively due to a few large projects. Two additional projects were added at the beginning of 2025, which further distort the overall volume. If the five largest projects - each with an investment volume of over CHF 60 million - are excluded, there was only a moderate increase of 1.3 % compared to the same period of the previous year.

Data centers dominate current construction activity

Three of the five largest construction projects of the past 12 months are not traditional office buildings, but data centers. In the first quarter, Global Technical Realty (GTR) received approval for the construction of a data center in Lupfig with an investment volume of around CHF 300 million. Another data center in Glattbrugg for CHF 60 million was also approved in the first quarter. At the end of 2024, the canton of Aargau approved a technology and data center in Laufenburg with investments of CHF 269 million. These three projects alone account for around 35 % of the total investment volume approved for new construction in the office segment in the last four quarters. "Although construction activity is therefore increasing, it is mainly concentrated on infrastructure with only a few office workplaces," summarizes Wüest Partner.

Short-term increase in supply of office space

In the 2nd quarter, the number of office spaces advertised across Switzerland was 0.7 % below the previous year's level. On the one hand, supply increased in the large and small and medium-sized centers, while declining advertising volumes in the agglomerations largely neutralized this effect. "However, a look at the short-term development shows a different picture: compared to the previous quarter, the supply of office space across Switzerland increased by 3.7 % or around 132,000 sqm," says Wüest Partner. All types of municipalities recorded an increase, with the most pronounced growth in the major centers, which saw an increase of around 65,000 sqm.

Office rents continue to rise

Office rents across Switzerland rose by 2.7 % in the 2nd quarter. The increase was driven primarily by the Zurich (+3.2 %) and Lake Geneva (+3.8 %) regions, which once again recorded above-average growth. In contrast, rental growth in the Basel (+0.7 %) and Bern (+1.0 %) regions, as well as in the rest of the country (+1.4 %), was significantly lower - "an indication of the increasing spread within the Swiss office market", according to the report.

Against the backdrop of slowing employment growth and a renewed increase in supply, Wüest Partner expects "office rents to trend sideways to fall slightly overall" in 2025. However, regional differences will remain: In the city center of Zurich in particular, rents are likely to continue to develop much more dynamically than in the other regions, according to the forecast. (aw)