Capital increase at Peach Property

Kreissparkasse Biberach, Peach Property's anchor shareholder, has increased its stake from 7.7% to 10.9% as part of a capital increase.

Peach Property Group has announced that its anchor shareholder Kreissparkasse Biberach has subscribed for 164,000 new shares in the form of a subordinated mandatory bond as part of a capital increase and is purchasing an additional 11,000 shares from the residential real estate company's holdings.

The subordinated bond has a volume of CHF 5.4 million and a maturity date of April 14, 2020, on which date it will be converted into Peach Property Group shares at a price of CHF 33.04. The subordinated bond has a maturity date of April 14, 2020.

After conversion and transfer of the additional shares, the shareholding of Kreissparkasse Biberach in Peach Property Group will increase from currently 7.7% to 10.9% measured by the number of shares currently registered in the commercial register.

Already since Oct. 2, Peach Property has temporarily reduced the conversion price of its SIX Swiss Exchange-listed 3% convertible hybrid bond with a nominal volume of 59 million from CHF 29.50 to CHF 28.50 until Oct. 18, 2019. After that, the regular conversion price will apply again, the company said. The conversion period at the regular conversion price ends on December 30, 2020.

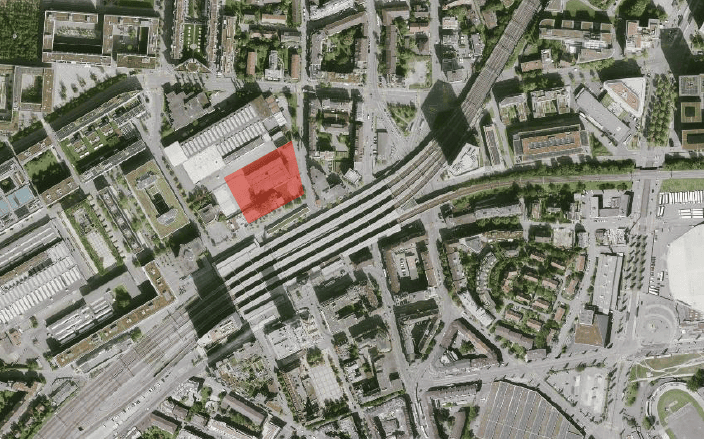

According to the company, the capital increase and the reduced conversion price of the convertible hybrid bond are related to the financing of the Recently announced acquisition of over 3,650 apartments in GermanyNo further equity measures are planned; the remaining purchase financing is to be provided by borrowing.

Upon completion of the purchase, Peach Group's residential portfolio will increase by 40% to approximately 12,450 units with a market value of approximately 1.1 billion. (ah)