Office market: Vacancy rate stable in Q3

However, CBRE has recorded lower quarterly take-up so far this year than last year and does not expect demand to improve again until 2027.

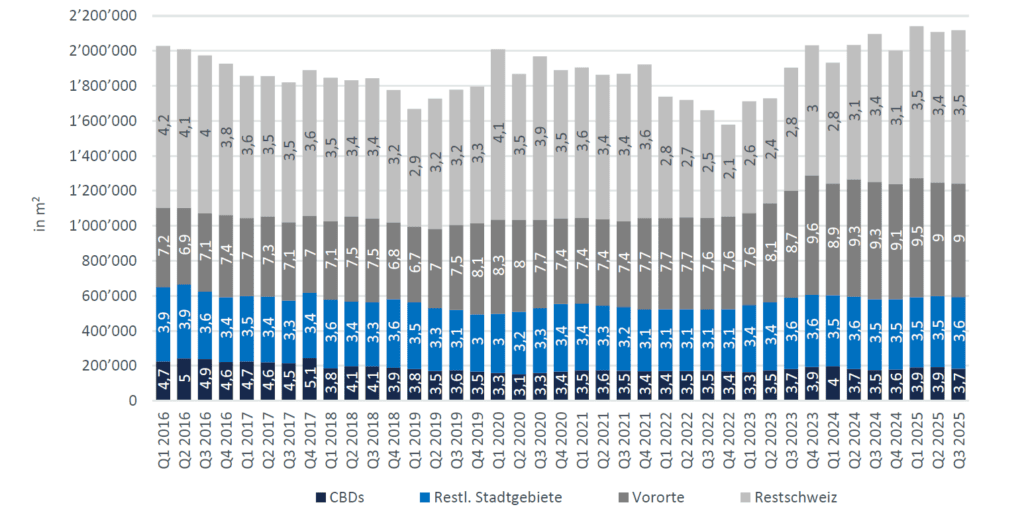

According to office market figures from CBRE Switzerland, the volume of available space remained stable in the third quarter. At 2.12 million sqm or 4.3% of the stock, the level at the end of September remained unchanged compared to the two previous quarters. However, this is the sixth consecutive quarter with office availability above 2 million sqm.

«This stability belies the fact that only an average quarterly take-up of around 425,000 sqm of office space has been recorded in the current year 2025,» writes CBRE in its market update. This had still amounted to around 540,000 sqm over the whole of 2024. Slower decision-making processes by companies and isolated withdrawals from letting processes have characterized the picture this year.

Job growth slows down

The reason for this is the lack of employment growth and increased cost pressure. The growth in full-time jobs in the typical office sectors - excluding the public sector - was a low 0.3% in 2024 and has fallen to just 0.1% this year. In the manufacturing sector, the decline in jobs from 0.2% in 2024 has worsened to 1.1% in 2025 to date, with the high US import tariffs and the strong Swiss franc having a particularly noticeable impact. However, the planned reduction in tariffs to 15% should prevent a further deterioration in the general demand for space, according to CBRE. However, employment growth is likely to remain subdued next year. «An improved demand situation is not expected until 2027,» the real estate agency concludes.

Further recovery expected for Basel

With the exception of the city of Basel, office availability in the urban areas of the five largest Swiss centers remains at a low level - an average of 3.7% in the CBDs and 3.6% in the urban areas outside the CBDs. This means that demand in central locations remains consistently good. The cities of Zurich (3.3%), Geneva (3.5%), Bern (3.1%) and Lausanne (2.7%) are characterized by an attractive market environment. In Basel, office supply remains above average at 5.6%, but should continue to recover slightly over the next few quarters.

9% Vacancies in the suburbs of large cities

The availability rate in the suburbs of Switzerland's major cities is stable at 9% and is generally benefiting from a continued reduction in new construction activity, although this is still much higher in the suburbs of the major cities in French-speaking Switzerland than in German-speaking Switzerland.