Review of the 107th Swiss Real Estate Talk

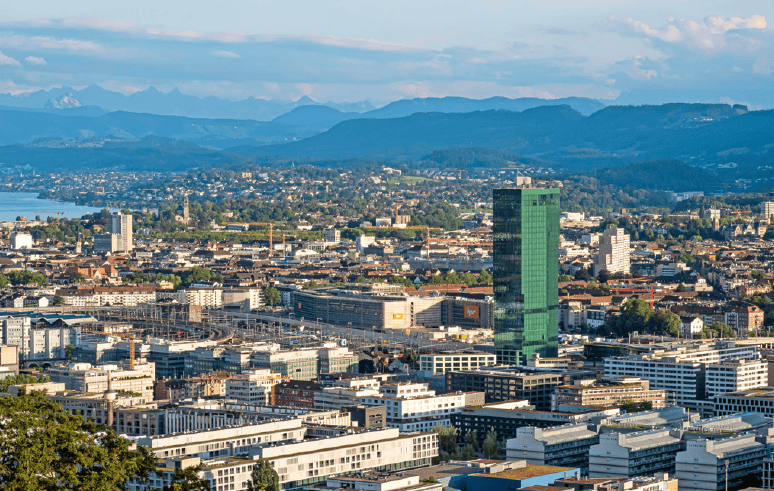

Natural disasters and climate damage: underestimated risks in portfolios? This was the title of the 107th Swiss Real Estate Talks, which took place at the Marriott Hotel in Zurich.

The fact that climate change is happening is undisputed - but how serious the economic damage to real estate portfolios will be depends heavily on local forecasts and models. At the 107th Swiss Real Estate Talk, organized by Galledia Fachmedien together with the SVIT Valuation Chamber, four experts shed light on how the sector must prepare for a «hotter» future. Under the moderation of Prof. Dr. Christian Kraft, it became clear that in addition to reducing CO₂ emissions (mitigation), adapting to unavoidable climate impacts (adaptation) is becoming a decisive value factor.

Global risk modeling and local surprises

Roger Baumann, COO and Head Product Development Global Real Estate at Zurich Insurance Group, gave an insight into the strategy of a global asset manager. Zurich follows a structured process to ensure that its USD 25 billion in assets under management are climate-resilient. Risks are first identified and prioritized at portfolio level before measures are examined for particularly exposed properties. Interesting for the Swiss market: while drought and hurricanes dominate globally, Zurich has identified wind and hail as increasing sources of danger in its domestic portfolio alongside flooding - a risk that many owners still underestimate.

Heatwaves as a creeping threat to market value

Jacqueline Schweizer, Partner at Wüest Partner, presented empirical data on the effects on the transaction market. While natural hazards such as floods or avalanches are already causing statistically significant price reductions of up to 5 percent (significantly more in the case of mudslides), another phenomenon is coming into focus: heat. Climate scenarios predict a drastic increase in tropical nights for cities such as Zurich - nights with temperatures consistently above 20 degrees. This is not covered by compulsory building insurance, as it is a continuous and not a sudden event. Schweizer warned: «It will not be those who have the best buildings today who will be successful, but those who have the data, models and decision-making tools to actively manage this uncertainty. The follow-up costs and declining attractiveness for tenants are increasingly being factored into valuations.

Practical example «Baarermatte»

David Guthörl, Head of Sustainability at the Allreal Group, showed what adaptation in project development looks like in concrete terms. Using the pioneering «Baarermatte» project in Baar as an example, he demonstrated visionary approaches: The area is designed according to climatic modeling, existing trees are elaborately relocated to guarantee immediate shade, and buildings are partly placed on supports to allow cold air flows and water runoff during heavy rainfall. Guthörl pleaded for climate simulations (wind, sunlight, heat islands) to be integrated in the earliest phases of site development and competitions. This is the only way to avoid costly planning errors and ensure the quality of life.

Stranded assets and the role of insurance

Jan Eckert, CEO JLL Switzerland, closed the circle with the capital market perspective. He identified three levels of impact: the transaction level, the portfolio level and insurability. The latter in particular is causing concern: in some markets, premiums are already rising massively or cover is being refused. A building that is no longer insurable becomes illiquid - a classic «stranded asset». Added to this is the regulatory pressure from the EU taxonomy and reporting standards such as IFRS S2, which require transparency about climate risks.

Conclusion: acting despite uncertainty

In the concluding discussion, the speakers agreed that Switzerland is privileged thanks to solidarity-based building insurance and good infrastructure. In Zurich, for example, the Sihl relief tunnel reduces the risk of flooding. Nevertheless, owners should not rest on their laurels. The data situation in the portfolio is also particularly important. «Collecting and building up information is key to identifying risks and being able to take countermeasures at an early stage,» summarized moderator Christian Kraft.