Review of the 104th Swiss Real Estate Talk

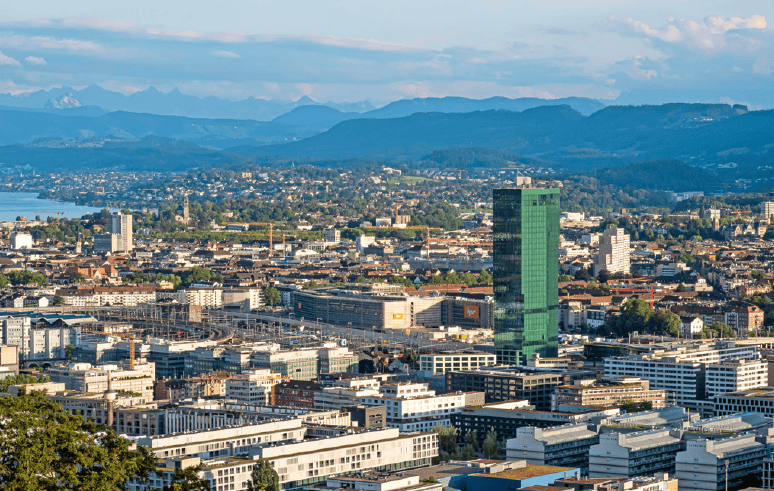

A high-caliber panel discussed the increasing tensions on the Swiss real estate financing market in Zurich's "Metropol". Moderated by John Davidson, four experts presented very different perspectives on the perceived credit crunch.

Moderator John Davidson opened the event and outlined the paradoxical initial situation: while mortgage interest rates are trending downwards and even five-year government bonds are yielding negative returns, many players on the real estate market are experiencing significant financing stress. "The end buyer is actually there, but there is a problem on the financing side," said Davidson. Headlines such as "Is the mortgage market facing a credit crunch?" illustrate the topicality of the issue.

Reduce big banks

Using figures, he showed that although mortgage growth is still positive at around 2.4 %, it is below the long-term average. An imbalance can be seen above all in the distribution of credit growth: While big banks such as UBS reduced their mortgage volume after the takeover of Credit Suisse, cantonal banks, Raiffeisen banks and pension funds in particular increased - at a low level.

Davidson emphasized the dominance of banks in the Swiss mortgage market and contrasted this with the US market, where banks now only handle around 30 % of residential mortgages. This raises the question of whether alternative forms of financing such as debt funds will also gain in importance in Switzerland. With this outlook, he handed over to the speakers, who were to shed light on the problem from the perspective of banking regulation, alternative financiers and developers.

Basel III as the main driver of the credit crunch

Adrian Wenger, Partner at VZ Vermögenszentrum, identified three main reasons for the tense situation. In addition to the merger of UBS and CS and the SNB's increase in the countercyclical capital buffer, the implementation of Basel III is the decisive factor. The regulation, which comes into force on January 1, 2025, will fundamentally reshape the capital adequacy requirements for banks.

Wenger explained the new, complex weighting factors. The massive change can be seen in construction financing for investment properties: Whereas previously a weighting factor of 35 % applied, loans with a loan-to-value ratio of over 70 % must now be backed by a factor of 150 %. This practically quadruples the equity capital to be deposited by the bank for such financing. "This naturally has an impact on the margin," emphasized Wenger. In order to achieve the required return on equity, the margins for construction loans would have to increase massively.

He identified private owners with low loan-to-value ratios who are building for their own use as the beneficiaries of this development. For them, the required equity backing is falling, which makes them a new, hotly contested target group for banks. For developers, on the other hand, supply is becoming scarcer and more expensive. His conclusion: the banks are still in an orientation phase, which will lead to restrictive lending in the coming years, particularly for loan-to-value ratios of over 60 %.

Debt funds as a flexible alternative

Kevin Hinder, CEO of Property One, presented debt funds as a possible solution to the financing gap that has arisen. He highlighted the market for subordinated mortgages, which is still small but growing rapidly. These alternative financiers are not bound by the rigid affordability rules or valuation models of the banks.

According to Hinder, the advantages for borrowers are flexibility and speed. Debt funds could finance projects even before planning permission is granted or without a full rent index, enabling developers to take advantage of market opportunities. Using practical examples, he showed how portfolio owners can grow through subordinated loans, developers can bridge the gap until they receive the construction loan (bridge financing) or buyers can secure an advantage in the bidding process through a quick financing commitment.

Hinder emphasized the high demand, which is being additionally fueled by Basel III. With a default rate of zero, this asset class is also an attractive addition for institutional investors, secured by real estate with a low correlation to other assets.

The practical perspective of a developer

Stefan Gabriel, CEO of Fortimo, provided a reality check from the perspective of a large, family-run developer. Although his company is in a solid financial position with an equity ratio of 40 %, the changed financing situation is clearly noticeable.

He confirmed the challenges described by Wenger: Capital requirements are increasing, which restricts liquidity. Financing large project volumes (CHF 50 million or more) in particular has become extremely difficult, as banks shy away from bulk risks. Another critical point is the massive increase in pre-sale quotas for condominiums, which are required by banks before construction can begin. "A requirement of 50 % sales quota before the start of construction is not realistic," says Gabriel.

He also observed that banks are increasingly making additional transactions such as foreign exchange transactions or fixed-term deposits a condition for granting loans. He cited diversification across numerous banking partners, including foreign institutions, and very disciplined acquisition as a survival strategy. Although subordinated financing is an option, it is one that should be avoided as far as possible due to the high costs involved and other options have been used up to now.

Normalization after abundance

In the final round, Zoltan Szelyes from Macro Real Estate put the term "credit crunch" into perspective. He spoke of a "normalization" after years of capital abundance, in which margins of 40 basis points were common. "I never had margins that low abroad," said Szelyes. The market is highly differentiated: financing owner-occupied residential property and good investment properties in the residential sector is still possible, albeit at higher margins of around 80 basis points. The actual financing stress is concentrated on the commercial sector and in particular on project developments, as described by the previous speakers.

The light at the end of the tunnel has not yet been sighted in the credit crunch, it was agreed. Some developers and borrowers could run into trouble, will this lead to price reductions as the dry powder on the equity side fizzles out? More talks to follow.....