Erres: Real estate fund reaches three billion threshold

In the 2024/25 financial year, Edmond de Rothschild SICAV slightly increased its rental income, purchased five properties and sold three properties, including one large one.

According to the annual report (reporting date: March 31), the Edmond de Rothschild Real Estate SICAV (Erres) real estate fund increased its portfolio by CHF 92 million or 3.20% to CHF 2.98 billion compared to the previous year. The increase includes CHF 55 million or 2.07% in revaluations while the real estate portfolio remained constant. The rental loss rate fell slightly from 2.10 to 1.98%. Net income improved by CHF 2.1% to CHF 53.9 million. Total income rose by 3.6% compared to the previous year, thanks to an increase in rental income of 3.1% to CHF 111.2 million. This was due to earlier acquisitions (CHF 2.5 million), new acquisitions (CHF 1.8 million) and a CHF 1.3 million increase in rental income from existing properties. The completion of projects contributed CHF 2.7 million.

Three properties were sold in the reporting period for an after-tax profit of CHF 9.6 million, which represents a net margin of more than CHF 7.2% on the cost price. The realized result increased by 0.3 % to CHF 63.5 million. The overall result increased significantly from CHF 29.5 million to CHF 70.6 million due to the positive revaluation.

Five real estate purchases totaled CHF 98.97 million. These are the properties Rue Jean-Charles Amat 14, Chemin de Challendin 1-3-5 and Rue du Nant 29 in Geneva as well as Ecu 15-17A in Vernier and Les Vergers-de-la-Gottaz 1-5 in Morges. The fund manager has also committed to 10 additional transactions in the form of forward purchases for the new financial year.

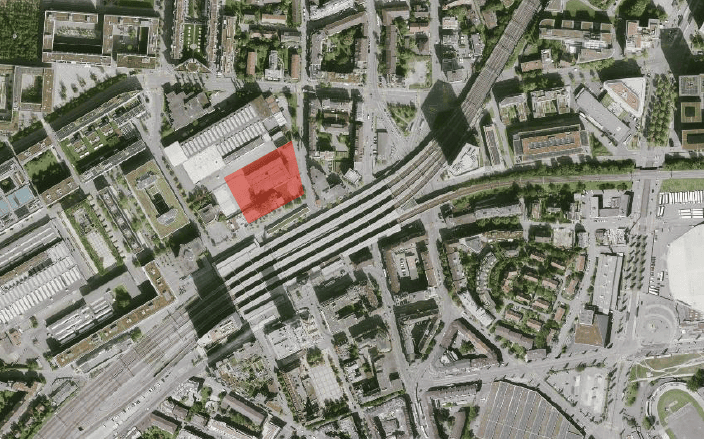

Large-scale sale in Meyrin

The fund sold three properties for CHF 142 million, namely Prulay 37 and Coopérative 5 in Meyrin and Casino 51 in Montreux. In the case of the two properties in Meyrin, increases in value were achieved through renovation and additions (Prulay 37) and through a construction and upgrade project (Coopérative 5). According to a French-language press report, the buyer of the latter property was Pensimo for the Turidomus investment foundation. Erres quotes the sale price at CHF 77.3 million. The sale of the property in Montreux for CHF 38.5 million was made "due to the high level of exposure to non-food retail and the flexibility in the risk management approach offered by the main tenant's lease agreement". (aw)