Wincasa wins mandate for Akara fund

The real estate manager receives orders for the management of the CHF 3 billion Akara portfolio from the new fund player BLKB, Arab Bank and TX Group.

Wincasa announces several new mandates, including the complete management of the Akara Swiss Diversity PK Fund portfolio. The SPS Solutions fund comprises 160 residential and commercial properties across Switzerland with a market value of CHF 3 billion. According to the press release, Wincasa will take over the majority of the portfolio as a full mandate from 2026. Previously, the commercial and technical management of the fund were assigned separately. The contract with Wincasa will be supplemented by "selective commercial mandates with external technical support", the service provider writes. Individual properties have already been taken over in advance.

Wincasa has also been commissioned to support BLKB Fund Management AG as a management partner from the outset in setting up its BLKB (CH) Sustainable Property Fund real estate fund. The fund's initial portfolio has a market value of around CHF 177 million. Other mandates include real estate management for the TX Group media group, for which Wincasa has been managing the commercial real estate portfolio with offices and printing centers since January. One of the company's most prominent properties is the media building in Zurich designed by Shigeru Ban.

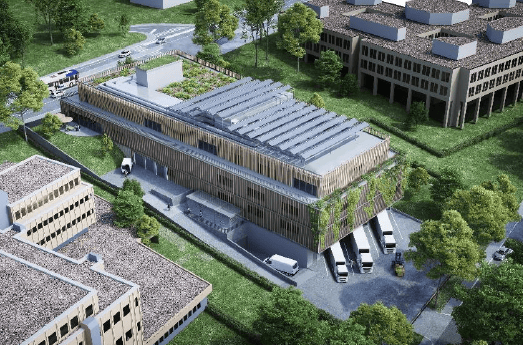

Finally, Wincasa is now also managing the Mix City Renens project, which is being realized by Arab Bank Switzerland. A building with modular space for offices, retail, gastronomy, production, logistics, sport and leisure is being built on around 11,700 square meters near Lausanne. In addition to MixCity, Wincasa is also supporting Arab Bank Switzerland with the QuarzUp project in Vernier, which is currently in the construction phase. (aw)